What is a Legal Entity Identifier (LEI)?

At its core, the Legal Entity Identifier (LEI) is a unique 20-character alphanumeric code. Its fundamental purpose is to create a single, reliable, and publicly accessible global directory of non-individual market participants. This system is designed to answer two critical questions with certainty: ‘who is who’ in a financial transaction, and ‘who owns whom’ in a corporate structure. An LEI can be obtained by any distinct legal entity, such as a company, partnership,

trust, or government body, but not by individual persons.

Historical Context and Development

The development of the LEI system was a direct and necessary response to the systemic failures identified during the 2008 global financial crisis. In the lead-up to and during the crisis, regulators and financial institutions struggled to quickly and accurately identify counterparties and trace financial exposures. The complex ownership structures of large financial institutions, which operated across multiple jurisdictions using different national identification systems, made it nearly impossible to assess risk in real-time.

Recognizing this critical vulnerability, the leaders of the G20 economies and the Financial Stability Board (FSB) agreed in 2011 to develop a coordinated global solution for unique entity identification. This initiative represented a fundamental shift from relying on disparate and siloed national identification systems, such as a Corporate Identification Number (CIN) in India, to a globally integrated framework for financial transactions. The creation of the LEI was a deliberate move to establish a single, universal standard to help regulators and risk managers monitor and manage financial risks more effectively.

LEI Adoption in India

In India, Legal Entity Identifiers are growing exponentially and businesses and organizations are adapting to this new form of legal entity identification number at a drastic rate. Even though the traditional forms of legal entity identification numbers in this jurisdiction such as TAN, PAN and CIN are still prevalent, businesses are adapting to the global legal entity identifier system as it is the only identifier system that comes with the ability to track the entire life cycle of a business even after transitioning to a new entity format. Whereas the traditional systems change, your LEI code stays consistent throughout.

At its core, LEI codes are a unique 20 character alphanumeric code assigned to a legal entity by a GLEIF accredited body known as a Local Operating Unit directly or through an intermediary called a registration agent. When obtaining your LEI number from LEI International Pvt. Ltd. (a Wholly owned subsidiary of TNV Global Ltd.), you are dealing with India’s first privately accredited LOU or LEI number issuer, cutting the intermediary channel completely which allows for faster processing and operations.

Global LEI System Structure

This global public-interest initiative is managed through a three-tiered structure:

The LEI Regulatory Oversight Committee (ROC) is a group of public authorities from around the globe, established in 2013, that coordinates and oversees the entire global LEI framework, ensuring it serves the public interest.

The Global Legal Entity Identifier Foundation (GLEIF) is a supra-national, not-for-profit organization established by the FSB in June 2014 and headquartered in Switzerland. The GLEIF is tasked with managing the operational integrity of the Global LEI System. Its responsibilities include ensuring high data quality, managing the network of LEI issuers, and making the global LEI data pool available as an open, online public resource. It is important to note that the GLEIF does not issue LEIs directly.

Local Operating Units (LOUs) are the organizations accredited by the GLEIF to provide LEI registration, renewal, and other services to legal entities. LOUs, also known as LEI Issuers (ex. TNV-LEI), are responsible for verifying entity data and issuing the unique LEI codes, leveraging their local knowledge of corporate structures and business practices.

LEI Code Design

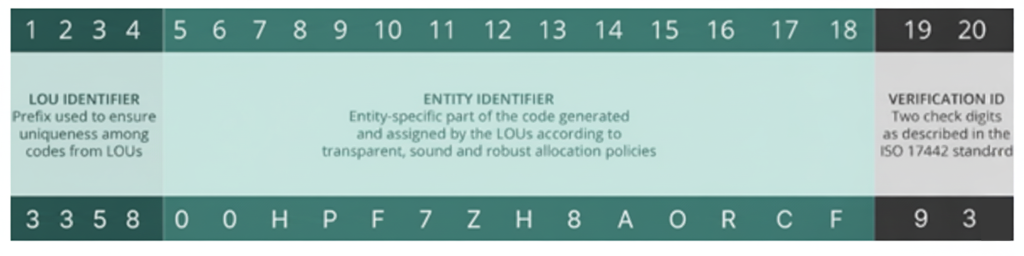

The structure of the LEI code is not random, it is meticulously and purposefully defined by the International Organization for Standardization in the ISO 17442 standard which gives us a breakdown of its specific components to ensure its uniqueness and integrity.

A critical design feature of the LEI is that the unique entity specific part of the code contains no embedded information, unlike other identifiers which contain a country code or an industry code. The LEI is a simple reference key, all the valuable business data that you see including the name, address, registration authority etc. is stored in the Level 1 data and all the direct and ultimate parent and child relationship and ownership structure data is stored in the secondary Level 2 data.

This entire data is stored in a separate database which is publicly accessible on the GLEIF

database and is linked to your LEI number. This meticulously designed system is remarkably robust and future proof, as mentioned earlier that the entity’s LEI code is permanent and never changes, even if the company relocates, changes its name or is acquired, only the reference data linked to that code is updated, ensuring stability and avoiding the hassle and complexity of reissuing codes. This makes the LEI a permanent and reliable identifier for the entire life of the entity.

Regulatory Purposes in India

The primary purpose of the LEI in India is to provide regulators, principally the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI), with a clear, unambiguous, and comprehensive view of financial transactions across the economy. Before the LEI, regulators had to aggregate data from multiple sources using different identifiers, a process that was often slow and prone to error. The LEI provides a “golden standard” identifier that allows regulators to connect the dots and see a single entity’s total exposure across various markets, including credit, securities, and derivatives.

This enhanced transparency is crucial for several regulatory objectives. It facilitates a more accurate assessment of total borrowing by corporate groups, helping to prevent over-leveraging and the concentration of risk within the system. Furthermore, by clearly identifying every party to a transaction, the LEI serves as a powerful tool in monitoring for market abuse, combating financial fraud, and strengthening anti-money laundering (AML) efforts. The ability to instantly and precisely identify parties to financial transactions allows regulators to better analyze and monitor threats to the stability of the financial system.

Business Benefits of LEI Adoption

Beyond its regulatory function, the LEI is increasingly recognized as a strategic asset for Indian businesses. Its adoption offers significant benefits that can improve both risk management and day-to-day operations. For businesses, one of the most direct advantages is in the area of counterparty risk management. The LEI system provides access to a free and open database of high-quality, verified data on legal entities worldwide. This allows an Indian company to clearly and confidently identify its transaction partners, both domestically and internationally, thereby enabling a more accurate assessment of counterparty risk. The LEI also drives substantial operational efficiencies. The process of client onboarding and conducting Know Your Customer (KYC) checks has traditionally been a time-consuming and costly exercise for financial institutions.

The LEI streamlines this process by providing a standardized and pre-verified identifier. Research conducted by McKinsey estimated that the widespread adoption of the LEI could save the global banking sector between 2-4 billion USD annually in client onboarding costs alone. For Indian businesses, this translates into faster data collection, simplified internal reporting, and a reduction in transaction failures caused by data reconciliation issues.

Finally, for Indian companies with global ambitions, the LEI acts as an international business passport. It signals to international partners and financial institutions that the company adheres to global standards of transparency and is a credible counterparty. In many jurisdictions, having an LEI is no longer optional. Major international regulations, such as the Dodd-Frank Act in the United States and the European Market Infrastructure Regulation (EMIR) and Markets in Financial Instruments Directive II (MiFID II) in Europe, mandate the use of LEIs for reporting financial transactions. Therefore, for an Indian company to participate in these international markets, obtaining an LEI is a prerequisite.

Strategic Infrastructure Development

The mandatory adoption of the LEI in India should not be viewed as an isolated policy. It is a strategic piece of infrastructure development that supports the country’s broader goals of financial digitalization and deeper integration with the global economy. A reliable, standardized digital identifier is a foundational “identity layer” upon which future financial innovations, such as automated underwriting and secure open banking APIs, can be built. By aligning its financial market infrastructure with global standards, India becomes a more transparent, less risky, and ultimately more attractive destination for foreign investment.

Competitive Advantages Beyond Compliance

Apart from only the legal requirements, we want businesses to see and recognize what is beyond what is mandatory. Getting an LEI number makes you stand out from the crowd and gives your business tremendous strategic advantage over your competitors. When you fall under not just India’s nationally recognized systems and the traditional identifications but are a part of a globally recognized global LEI system which is accessible worldwide, you get a competitive edge which is super strategic in nature and helps you land business easier with your international potential clients and also gives you credibility and instills trust between you and your clients making them feel more confident to do business with you.

LEI goes just beyond mandatory requirements but also alters the psyche of the counterparty and their perception of who you are as a business. This wave of voluntary adoption shows that you have nothing to hide and are willingly getting yourself registered and opens doors for several opportunities. Just as people get MSME certificates to show an association under a wider recognized scheme to gain trust and confidence of other businesses/clients, LEI does just that but takes it a step above and makes it global.

Rationale Behind the LEI Mandate

The mandatory implementation of the LEI is not just a random regulatory hurdle, it is a strategic move to fortify the Indian financial system with certain core objectives such as enhancing transparency and unambiguous identification systems for all legal entities participating in the financial markets. This helps in tracking transactions and understanding the interconnectedness of various market participants, assisting government bodies with anti-money laundering practices.

It also helps in robust risk management as it provides a clear picture of who is transacting with whom and the system enables regulators and financial institutes to better assess and manage systemic and counterparty risks. In the event of a financial crisis, regulators can quickly trace the exposure. It also assists in prevention of financial frauds as it makes it significantly harder for fraud, for example, it can help prevent a single entity from using the same collateral to obtain loans from multiple lenders.

It also makes the KYC process simpler and strengthens the process for financial institutions as it provides a globally recognized and verified identity.

How to Obtain an LEI

In the end, to obtain an LEI, a legal entity must apply through a Local Operating Unit that has been officially accredited by the Global Legal Entity Identifier Foundation. These organizations are authorized to issue and manage LEIs within their designated jurisdictions. LEI International Pvt. Ltd. is India’s first privately accredited LOU by GLEIF and is a wholly owned subsidiary of TNV Global Ltd. Apply for or renew your LEI number with LEI International Pvt. Ltd. today! Visit tnvlei.com to find out more and choose the best plan for your company.